Featured In

Secure Your Future: The Complete Jim Lusk Retirement Mastery Collection

Unlock the wisdom of Jim Lusk’s four decades in financial planning with his complete collection of books: “Die Neatly,” “Money Machines for Life,” and “The Pension Shield Option. Each title delivers clear, actionable strategies to help you build a resilient financial life, maximize your retirement income, and create a legacy that endures. Whether you’re seeking peace of mind, practical guidance, or innovative ways to protect your future, Jim’s trusted insights are your essential roadmap. Discover the proven tools and expert advice you need to secure your financial journey—start reading today.

Jim Lusk, CFP, CLU, ChFC, CLF, MEd – President

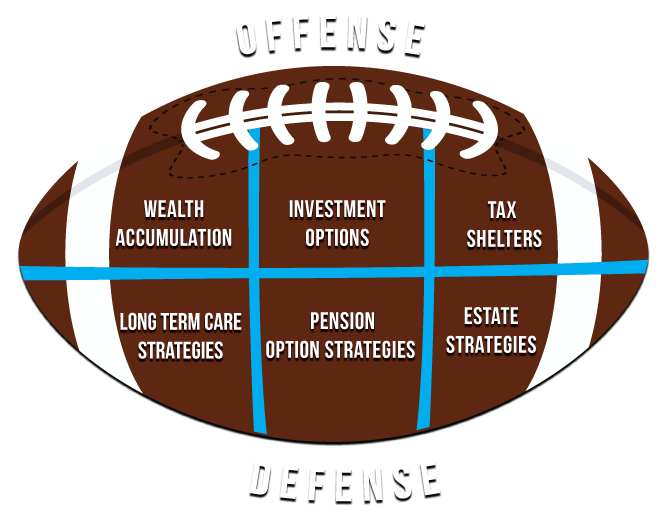

Since 1983, Jim Lusk has dedicated his career to the fields of life insurance and financial planning. He stands out as a teacher, mentor, inspirational leader, and recruitment expert, specializing in defensive financial planning systems. Jim holds the conviction that numerous financial strategies fail to address potential uncertainties. He advocates for “Defensive Financial Planning,” emphasizing the importance of establishing a robust foundation akin to constructing a durable house.

“It’s amazing that people spend a month to plan a week’s vacation in Hawaii and yet they’ll work 30 years and not spend a couple of hours studying their pension options”

– Virginia Faust

need a consultation? let’s talk.

Securing Your Future: Expert Retirement and Succession Planning

At Retirement Nationwide, we specialize in guiding public and state employees on their journey to a secure retirement. For business owners and executives, our expertise extends to comprehensive succession planning. Our deep understanding of the retirement and pension landscape ensures there’s virtually no challenge we can’t navigate for you.

accomplish

Our priority is ensuring that you and your family are well-prepared for the future.

maximize

Guiding your financial path from pre-retirement to beyond.